In today’s fast paced manufacturing world, having an experienced team of accountants can be vital to maintaining margins and remaining competitive.

In recent times, we have been able to offer an extra level of support for clients, including guiding their post-COVID-19 responses and advising on government grant funding and finance.

We support manufacturers of

Rouse Partners breadth of experience and service teams means that we can have confidence they are able to offer us additional support and guidance in the future as and when it is needed. For example, we recently received advice on setting up a tax-efficient Enterprise Investment Scheme (EIS) for investors in addition to the regular grant funding work that Rouse has provided. Ross Robotics See more >>

Rouse Partners breadth of experience and service teams means that we can have confidence they are able to offer us additional support and guidance in the future as and when it is needed. For example, we recently received advice on setting up a tax-efficient Enterprise Investment Scheme (EIS) for investors in addition to the regular grant funding work that Rouse has provided. Ross Robotics See more >>

I have always found working with Rouse to be very efficient, professional and friendly. They are always looking at ways to add value to my business, a recent example being the R&D Tax Relief scheme which has been a great success. I would not hesitate in recommending Rouse. Martin Davies

I have always found working with Rouse to be very efficient, professional and friendly. They are always looking at ways to add value to my business, a recent example being the R&D Tax Relief scheme which has been a great success. I would not hesitate in recommending Rouse. Martin Davies

We’re accountants for manufacturers

We’re a forward thinking team, large enough to offer a wealth of experience and specialisms, yet small enough to retain an approachable, trusted client relationship – so you get the best of both.

Need international support?

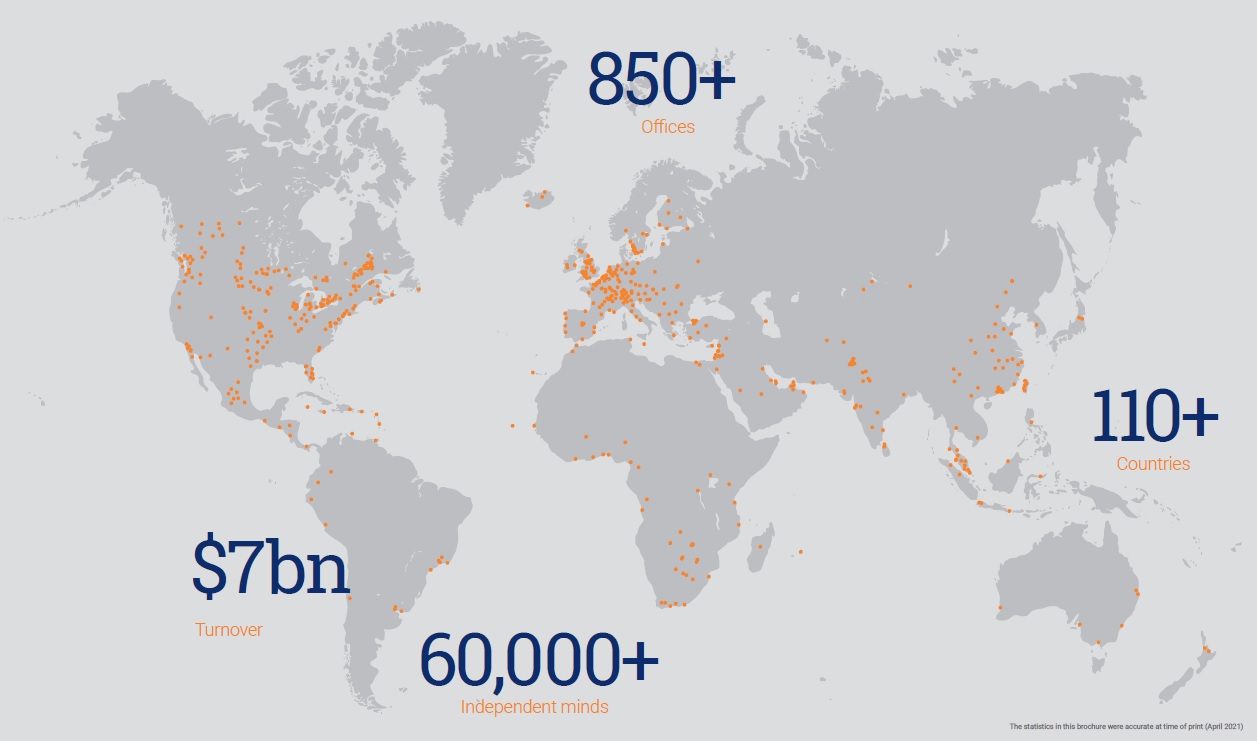

Whether you are importing goods from Asia, outsourcing customer service to Eastern Europe, opening a sales office in South America, or initiating an expansion plan in the United States, we can support you.

As a member of the Praxity Alliance we can support you in the territories that you already operate and those you are interested in exploring.

This award-winning alliance connects us with independent, hand-selected advisors who we know and trust, in more than 100 countries worldwide.

Related insights

Full Expensing: Can you use capital allowances to make tax efficient purchases?

The Capital Allowance Super Deduction: Still time to claim but act quickly

Get in touch

Whether you have a specific query, would like to discuss how we can help or for a no obligation quotation, complete this form and and we will get back to you as quickly as we can.