In this guest article, Julian Buckeridge of executive search firm, NGS Global UK, discusses the key strategic components for companies with China ambitions.

Do you have the right organisational structure for your business in Asia? If China is a big enough part of your revenue, or you want it to be big enough, then shouldn’t it be treated as a region in itself?

To that end, shouldn’t your China leader be part of your global executive leadership team, and your China operations be a unique business unit?

Most multi-national corporations (MNC’s) have traditionally set out their strategic, commercial and operational objectives on a region-by-region basis, with Heads of APAC reporting into global. This is now changing as companies realise the current and near-term consumer and purchasing potential of China and align their organisation to capture a share of the world’s largest marketplace, unencumbered by other Asian markets.

Massive but not Homogenous Market

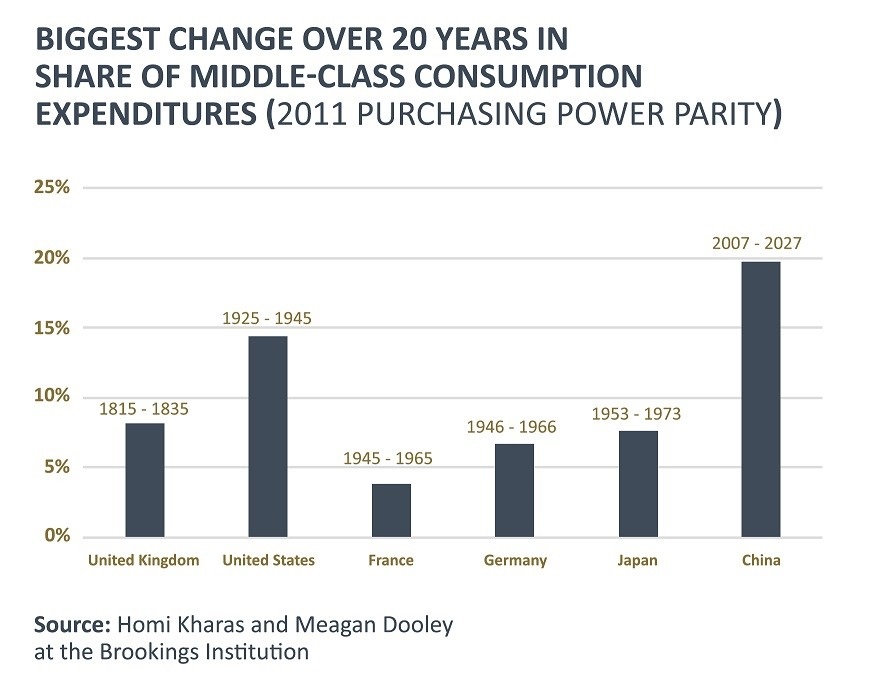

The country has the world’s biggest middle-class (400 million people in 2018) which will grow to 1.2 billion by 2027. This will be a quarter of the entire planet’s middle class in one country…in six years from now. China has more wealthy people (defined by those with a net personal wealth of at least US$100,000) than the US (100 million vs 99 million). And even though it does not have the highest number of millionaires in the country (the US has slightly more), it has more billionaires than the US and India combined (658).

The sheer size and scale are compelling, but China is far from a simple or homogenous market. As a mixed socialist market economy with strong regional dynamics, the country is undergoing rapid and fundamental changes in consumer behavior, e-commerce and the rise of Chinese competitors focused 100% on their native market.

This makes for a fiercely competitive commercial environment, particularly when in some cases, these domestic companies have been active in acquiring Western firms (for example, China’s Anta Sports bought Finland’s Amer Sports – owner of Arc’teryx Salomon, Atomic and Suunto). This focus and opportunity mean that top talent is attracted to companies that make China a strategic priority.

Leadership Profiles are Rapidly Changing

These changes are having profound effects on the profile of leaders in China. They are younger, more diverse and more e-commerce savvy than their old economy global leaders and the previous generation of leaders were. Unlike Japan or Korea, this is a highly competitive meritocracy, and many of the most iconic new economy leaders achieved notable success in their 30’s. Such changes are not limited to commercial organisations across the country – they have also been taking place in political and administrative leadership circles throughout Chinese society.

NGS Global’s team in China have undertaken several mapping exercises for clients and partners, assessing the talent acquisition landscape in the country. There is intense competition for executive pedigree from Chinese brand owners and innovators such as Jiangxiaobai and DJI, and e-commerce and tech companies (see RED Group, Baidu, Alibaba Group, Tencent, Kuaishou, JD.com) as well as smaller start-ups. There is also a large amount of private equity and investor backed ventures that are attracting top talent to portfolio companies with the offer of equity and sharing in the value creation.

In their book China CEO II, Dr Laurie Underwood and Professor Juan Antonio Fernandez interview 25 China CEO’s of leading MNC’s, and compare the landscape of CEO’s in the country today with 15 years ago (when they wrote their first China CEO book).

The book reinforces our findings that today’s leaders in China are younger, more Chinese, more female, more technically savvy and more culturally adept. Several examples include:

- the Starbucks Coffee China Chairman and CEO (Belinda Wong, 50 years old and part of the Starbucks global executive leadership team since she was 47)

- Chinese dairy company Yili Group Chairman and CEO (Pan Gang, now 51 but was appointed to the position at 35)

- Sports equipment company Xtep CEO (Holly Li, now 50 but has tenured the role since the age of 42)

- YUM China Holdings CEO (Joey Wat, now 48 years old, appointed when she was 45).

“It is essential that MNC’s have a triumvirate of China-specific products and supply chains, strong and autonomous leadership teams who have deep expertise of the Chinese market, and an integrated omni-channel marketing strategy which targets their potential buyers in a meaningful and coordinated way.”

What’s Next for MNC’s?

Interestingly, we have found that this generation of China business leaders do not expect to move into an APAC role or out of China, but desire to stay within the country and run increasingly large complex China operations. They are more likely to see their careers moving into private equity backed C-suite like McDonalds China, owned by CITIC Capital and Carlyle, or working for China enterprise global leadership roles like NASDAQ listed YUM China.

The challenge for MNC’s is how to attract and retain talent at the senior leadership level in China, particularly when many of them still have a broad Asia structure, and have not yet set up structurally and strategically to maximize the opportunity that China represents for them in the future.

In order to succeed in China, it is essential that MNC’s have a triumvirate of China-specific products and supply chains, strong and autonomous leadership teams who have deep expertise of the Chinese market, and an integrated omni-channel marketing strategy which targets their potential buyers in a meaningful and coordinated way. Top talent in China is attracted to roles that allow them to focus fully on growing the business in what is an increasingly sophisticated, competitive and fast changing landscape.

Julian Buckeridge and NGS Global’s team in China, with offices in Beijing, Shanghai and Hong Kong, can assist your organisation with executive search, talent mapping and executive leadership consulting.

Award-winning chartered accountants offering tax, audit and advisory services.