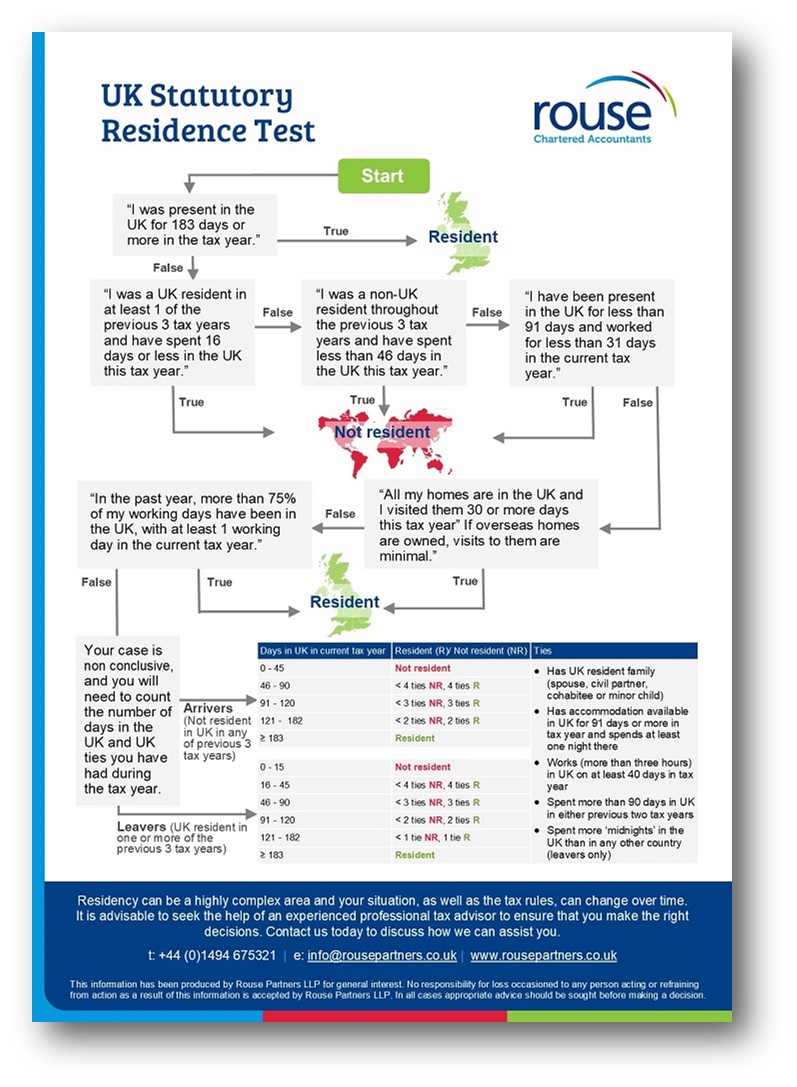

If you satisfy any of the automatic tests then you have certainty on your position for that tax year. Where none of the automatic tests are satisfied, the situation becomes more complicated and requires your ‘ties’ to the UK to be identified.

To help we have produced this handy flowchart for you. To view the PDF or print, please click on the flowchart image or follow this link.

Contact us

Residency can be a highly complex area and your situation, as well as the tax rules, can change over time. It is advisable to seek the help of an experienced professional tax advisor to ensure that you make the right decisions. Contact us today to discuss how our experienced tax team can assist you.

Award-winning chartered accountants offering tax, audit and advisory services.