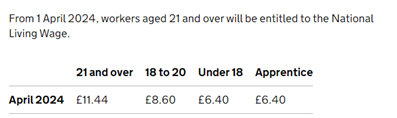

1. NMW rates to increase

The National Minimum Wages (NMW) rates are to increase and the top band abolished, meaning that employees who are age 21 and over will receive the National Living Wage:

2. Holiday accruals

For the leave year starting on or after 1st April 2024 there will be a new method of accruing holiday for any part-year and irregular workers. The employers will be allowed to use 12.07% of hours worked to accrue leave for those employees.

However, please note that the 52 weeks average earnings calculation will still be required to calculate the rate at which employees need to be paid. Furthermore, in the 52 weeks average calculation the employer will include the zero pay weeks, but exclude the weeks that were statutory parental leave or sickness was paid.

3. Rolled up holiday

Employers will be able to pay Rolled up holiday as part of their regular pay cycle. This means that instead of paying employees their accrued holiday, this is paid every pay period in addition to the employees’ regular pay.

Employers can use the 12.07% method to calculate the accrued hours for relevant employees but still need to use the 52 weeks average earnings to determine the rate at which this leave needs to be paid at. Note that the holiday pay should be paid at the same time as the worker is paid for the work done in each pay period.

4. Paternity leave

From 6th April paternity leave can be taken in two separate blocks of one week leave within the first year of the child’s life.

It will require two sets of notices given to the employer:

- 1st notice at 15 weeks before the expected week of childbirth and,

- 2nd notice to be served four weeks prior to each leave period.

5. Troncs and tipping (from 1 July 2024)

New tips, service charge and tronc legislation is on the way from 1 July 2024 for all employers taking and distributing gratuity payments to their staff.

The key aspects of the new legislation are:

- 100% of tips and service charge must be allocated to staff members.

- Tips must be paid in full to employees no later than the end of the next calendar month after they are received.

- Employers and independent troncmasters will be obliged to publish a clear policy relating to tips and how they are allocated.

- Employees may request their personal tips statement as well as the tips statement for a venue, as long as there is no other personal data of other employees included.

- For those operating a Tronc to allocate workers tips, they will need to make sure this meets the new rules and will be fit for purpose.

You can read our more detailed summary on the new tipping rules here.

Contact us

We will be covering these points and any necessary actions with our payroll clients in due course. If you have any questions in the meantime, please do contact your payroll contact at Rouse.

If you would like to discuss and find out more about our payroll service, please contact us today.

Ula heads up our Payroll team and supports businesses ranging from SMEs to large corporates.